the 50-30-20 budget rule

In my budgeting basics article, I discussed the steps involved in creating your first budget. I also introduced the 50-30-20 rule, a helpful rule-of-thumb to design your budget. In this article, I explain the 50-30-20 rule and provide examples.

the 50-30-20 rule

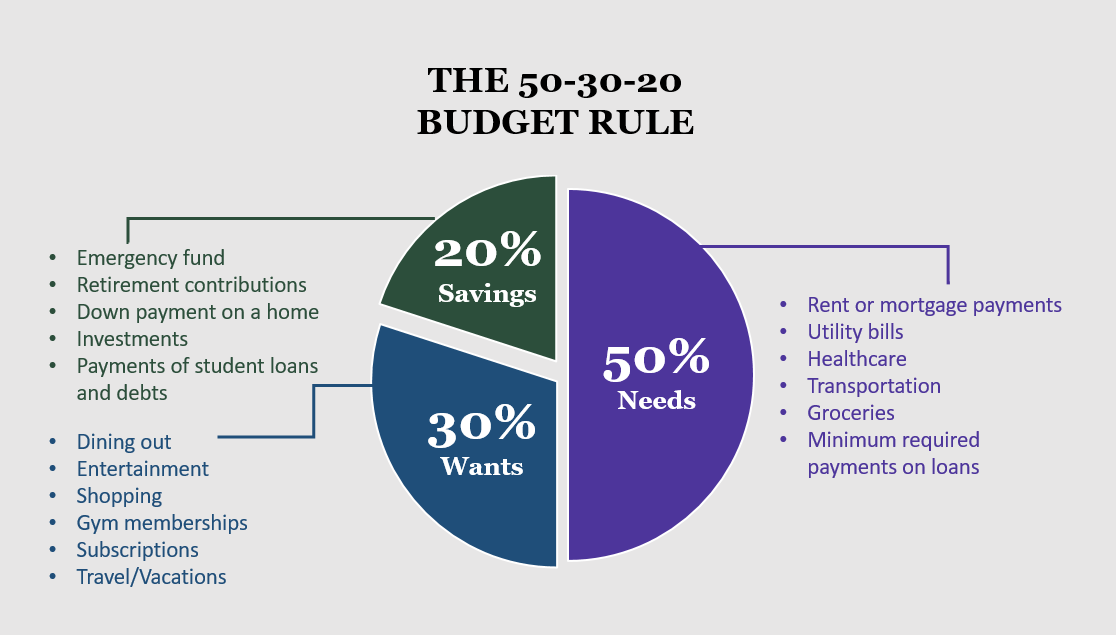

The 50-30-20 rule has long been hailed as a simple and effective guideline for budgeting and managing personal finances. This rule advocates dividing monthly income into three categories – 50% for needs, 30% for wants, and 20% for savings and debt repayment. It aims to strike a balance between essential expenses, discretionary spending, and building a financial safety net.

What goes into each category of the 50-30-20 rule? See below:

Needs: 50%

Needs are expenses that cannot be avoided. Categories that fall under this bucket include:

Rent or mortgage payments

Utility bills

Healthcare

Transportation

Groceries

Minimum required payments on loans

While the expenses that fall under this bucket are considered necessities, this does not mean that you have no control over how much you spend on needs. Spending more than 50% of your after-tax income on needs may be a sign that you need to downsize your lifestyle. For example, if you recently purchased a 3 bedroom home, you may consider renting one of the bedrooms out. The rental income could offset your mortgage payment to where your effective mortgage expense would be small or nonexistent. Another example is transportation. While transportation to and from work is often a necessity, leasing luxury cars is certainly not a need and you could save significant money by buying a used car.

If you are looking to cut down your expenses on needs, it is helpful to note that small savings in big ticket categories (e.g., rent/mortgage payments, transportation) will go a longer way than reducing how much you spend on smaller expenses (e.g., groceries, utility bills). If you live in a high-cost area and cannot decrease your expenses in needs, you may have to reduce your spend in your wants bucket to make up for it.

Wants: 30%

Wants are expenses on things that you enjoy, but that are not necessities of life. You spend money on these items by choice. Common wants include:

Dining out

Take out

Entertainment (e.g., movies, concerts)

Shopping

Gym memberships

Subscriptions

Vacations

Savings and debt repayment: 20%

Savings are the amount you put aside to prepare for the future. Savings may take the form of:

Emergency fund

Retirement contributions

Saving toward a down payment on a home

Investing in the bond or stock markets

This bucket also includes expenses you incur when you pay down your student loans and debts beyond the minimum payment.

While putting aside 20% of your income for savings is a healthy goal, note that the more you can save, the quicker you will fulfill your lifetime goals. For example, there is a movement called FIRE (Financial Independence, Retire Early) that has grown in popularity over the last few years. It involves individuals engaging in extreme frugality in order to retire far earlier than traditional budgets and retirement plans would permit.

Under the FIRE movement, individuals save as much as they can with the goal of reaching enough savings to where they can live from their savings throughout their long retirement. The magic number in the FIRE movement is 4%. You first decide how much money you need per year during retirement and divide that number by 4% to get a sense of how much you need to save up prior to retiring. For example, imagine that you decide that you can live off of $40K per year in retirement. You would then need $1M in invested savings ($40K / 4% = $1M). In normal market conditions, the invested savings will replenish themselves and you would have enough savings to withdraw $40K for the rest of your life. If you are considering joining a movement like FIRE, it wouldn’t be uncommon to save over 50% of your income each year.

how to the apply the rule

You can easily apply the 50-30-20 rule to your finances, using the steps below and this budget template:

Start with your monthly after-tax income

Add in your expenses for the prior month

See how well your expenses adhere to the 50-30-20 rule-of-thumb. The template will automatically pull categories and classify them correctly by needs, wants, and savings and debt repayment

If you need to adjust, create a budget for the next month that would adhere to 50-30-20 rule, noticing areas where you can cut down on costs

Track progress each month to see how much you spend versus how much you have “budgeted”

Continue looking for ways to reduce your expenses in the needs and wants categories while still having enough to enjoy life. Remind yourself that sometimes less is more

helpful tips and tools

Putting the rule in practice can be simplified by setting up automatic deposits, such as automatic contributions to your 401(k). You can also use a digital app like Mint that allows you to track both your income and expenses automatically by connecting to your bank and credit card accounts and displaying a summary for you that is easy to digest.

ADVICE ON OVERCOMING CHALLENGES

Despite the 50-30-20 rule’s apparent ease, many individuals find it challenging to stick to this rule and consistently allocate their income accordingly.

Common reasons for struggling to adhere to the 50-30-20 rule include:

Insufficient Income: For families with low income or in high-cost living areas, the 50-30-20 rule-of-thumb may be unrealistic. This constraint can lead to prioritizing short-term needs over long-term financial goals.

Lifestyle Inflation: As an individual’s income increases, there is a tendency to upgrade their lifestyle, leading to an increase in spending on discretionary items. This inclination can conflict with the 50-30-20 rule, making it harder to limit expenses under wants to 30% of their budget.

Unexpected Expenses: Life is notorious for throwing curveballs, and unexpected expenses can disrupt the delicate balance of the 50-30-20 rule. Medical emergencies, vehicle repairs, or home maintenance can erode the allocated amounts for needs, wants, or savings, forcing individuals to shift their financial priorities temporarily.

Lack of Financial Discipline: Adhering to any budgeting rule requires discipline and willpower. Often, people struggle to resist impulsive purchases or to diligently save according to the 50-30-20 rule. Without a strong commitment to their financial goals, it becomes easy to deviate from the designated percentages.

While these challenges are extremely valid, there are some strategies for overcoming them:

Track and Analyze Expenses: Understanding spending habits is crucial to managing finances effectively. Tracking and categorizing expenses will allow you to identify areas where you may be overspending and make the necessary adjustments to more closely align with the 50-30-20 rule. You might find that some expenses you are not able to reduce right away, but you might be able to down the road with some planning. The exercise will help you think of ways to optimize your life so that you invest in yourself first.

Prioritize Essential Needs: When income is limited, it is vital to prioritize essential needs, such as housing, utilities, and health care. This may require making sacrifices on discretionary spending temporarily until a stronger financial foundation is established.

Automate Savings: If you struggle with financial discipline, setting up automatic transfers to a separate savings account can ensure that the 20% allocated for savings or debt repayment is consistently set aside. Automating this process eliminates the temptation to divert money meant for savings towards wants or unexpected expenses.

Embrace Flexibility: Adhering strictly to the 50-30-20 rule may not be feasible in all circumstances. Flexibility is key when facing unexpected expenses or changes in income. Adjusting the percentages temporarily or prioritizing specific financial goals can help maintain financial stability during challenging times. Just make sure that you set a plan in place for how you plan to realign yourself with the 50-30-20 rule over time.

Financial progress is a journey, and with dedication, perseverance, and adaptability, it is possible to find success even amidst difficulties. The 50-30-20 budget rule is popularly used due to its ease of implementation and visibility. By applying the rule to your own situation, you may notice ways in which you can cut down on expenses and reach your goals more quickly.