RENT VERSUS BUY: CALCULATOR and considerations

The decision to buy or rent a home is one of the most significant financial choices a family can make. The choice is made more difficult by all the factors that go into it, such personal preferences, housing market conditions, and costs.

For me, the choice was easy. I decided to buy a home because I knew that I wanted to grow roots in my town and wanted to build equity in a home, with the goal of eventually buying a bigger place and turning my first purchase into a rental investment. However, the right decision may be different for you. This article highlights the pros and cons of renting and buying in addition to considerations you should take into account when making a decision. I have also shared a rent versus buy calculator where you can input data about your market and potential purchase and see whether it is financially better to rent or buy.

advantages and disadvantages of home ownership

The American Dream has often centered around home ownership. Today, 64% of Americans own the home they live in. Yet, owning a home may not be the best decision for every family. Let’s start by discussing the advantages and disadvantages of renting versus buying:

advantages of renting

Flexibility: Renting offers greater flexibility than buying a home. This may be important if you value the ability to easily move to a different city or neighborhood in pursuit of better career opportunities

Fewer unexpected and administrative costs: When you rent, your landlord is primarily responsible for maintaining and repairing the property (e.g., mowing the lawn, fixing the roof), saving you both time and money. They are also responsible for administrative costs, such as HOA fees and property taxes, reducing your financial burden

Lower market risk: A homeowner’s wealth fluctuates with the value of their property value. Unlike homeowners, renters do not bear the risks associated with fluctuating values. This is because while their rents can rise, increases in rent tend to be small each year and are not tied to their total wealth

Lower initial cost: Renting typically requires a lower upfront cost, such as a broker’s fee and security deposit. Buying on a home, on the other hand, typically requires a 5% to 20% down payment and closing costs equivalent to 4% of the sale price of the home

Lower monthly costs for borrowers with low credit scores: If you have a low credit score, you may be penalized with a high mortgage rate. Your rent payment is not dependent on your credit history and thus will not be impacted by a low score

DISadvantages of renting

Lack of equity: Effectively all the money put into rent is money that is lost. Rent payments do not contribute to building equity, eliminating your home as a method of wealth accumulation

Limited control: For many, customizing their homes to their personal preferences may be one of the most fulfilling aspects of home ownership. Renters face restrictions on decorating, remodeling, or other changes to the property

Uncertainty: Renting can provide a sense of instability, because you may need to move when your lease ends, and you have no control over the property’s future

advantages of buying

Builds equity: Each mortgage payment you make builds equity, helping you increase your net worth over time

Acts as a financial investment: Real estate has historically been a solid long-term investment. In my hometown of Fort Lauderdale, property values have generally appreciated over time, providing homeowners with the ability to accumulate wealth as property values rise. Buying a home also allows you to earn monthly income if you decide to rent out the property down the road

Builds credit history: Making on-time mortgage payments will steadily improve your credit score over the course of your mortgage

Stability: Owning a home can provide a sense of stability and security. You have control over your living space and can make it truly your own, with no landlord restrictions

Tax benefits: In many cases, homeowners can take advantage of tax benefits (e.g., mortgage interest deduction, property tax deduction) to offset some of the costs associated with ownership

disadvantages of buying

High initial costs: Purchasing a home often requires a substantial down payment, closing costs, and ongoing maintenance expenses

Market risks: The real estate market can be volatile, and property values may not always appreciate as expected

Inflexibility: Buying a home can tie you down to a specific location, making it challenging to relocate for a job opportunity or personal reasons

renting versus buying considerations

So how do you decide whether it is better to rent or buy in your individual circumstance? There are a handful of factors that you should consider, including cost. In this section, I introduce a rent versus buy calculator I created, which tells you which option will be less costly in your market. However, cost is only one consideration you should take into account. In the next section, I discuss additional factors you should think about as you make the decision.

You can start by downloading the rent versus buy calculator. We will fill it out together, using a sample case. Once you understand how it works, you can fill it out using details from the purchase you are considering.

property details

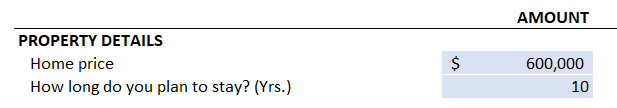

We are going to use buying a home in Fort Lauderdale in October 2023 as our sample case. At a high level, the overall cost of living in your city can impact your decision to own or rent a home. In a city with a competitive and expensive housing market, owning a home may be out of reach for many people. In this case, renting may be the only option.

Our first input is the home price. Let’s image that the home we are looking to purchase is on sale for $600,000. We can enter that in the first blue field.

Next, we have to estimate for how long we plan to stay in that home. The longer you stay in a town, the more it makes sense to buy a home because the upfront and closing fees are spread out over a longer time period. Consider:

Do you have family in the city you are living?

Do you have a good job in your city?

If you decided to move, would you keep the house and rent it out or would you put it up for sale?

Buying and selling a place can be very expensive and it might take a couple of years to recoup your investment. Therefore, it often doesn’t make sense to buy a home if you are likely to have to sell it in the near future.

In this instance, we have decided that we will stay in the home for at least the next 10 years.

MORTGAGE DETAILS

After completing the first section, we have to input details about the mortgage. Obtaining these inputs is relatively straight-forward. First, you must add the mortgage rate you expect to pay. In this instance, I added the average 30-year fixed rate mortgage rate at the time I was creating the calculator. In other words, I assumed that we will have to pay an annual interest of 7.49% on the mortgage. Since this rate can vary significantly month-to-month, make sure to update it based on your circumstances and what is available.

After adding the mortgage rate, we must add the required down payment on the mortgage and the length of the mortgage. Since a 20% down payment and 30 year mortgage is typical, we have assumed those numbers in the calculator.

MARKET FACTORS

Next, we must consider market conditions in the city. Have property values been on the rise? What about rent prices? While it is impossible to predict what the market will hold, you can use historical data as a proxy.

In the calculator, I added the 20-year average home price growth rate, rent price growth rate, investment return rate, and inflation rate. Unless you can have more granular data for your specific market or you are using the calculator for the purchase of a home that you plan to keep for only 1-3 years, I recommend keeping the assumptions as-is. The reason is that these values fluctuate significantly from year-to-year but will average close to the numbers inputted over a long period of time.

For our Fort Lauderdale example, imagine we have decided to keep the assumptions fixed. This means that we have assumed that over the next 10 years, home prices will grow at 5.26% per year, rent prices will grow at 3.25% per year, our investments will return 7.64% per year, and inflation will grow at 2% per year.

As a side note, if you are completing this section and notice that home prices have been growing more over the last two years than their average over the last twenty, you should proceed with caution. It may be that your city is experiencing a housing bubble and that price growth rates will re-adjust in the near future.

TAXES

Property taxes vary significantly by city and can impact the overall cost of owning a home. In some cities, property taxes may be so high that it may make more financial sense to rent.

It's important to research the property tax rates, in your city and factor them into your decision-making process. You should also consider other taxes, such as state and local income taxes, which can impact your overall cost of living.

In our example, we have inputted the average property tax rate in Florida: 0.89% (the website includes the average for each state). We have also set our marginal tax rate to 20% and our expected capital gains tax rate to 15%. These numbers will become important when the calculator takes into account the taxes we will owe and the tax deductions we will benefit from.

CLOSING COstS

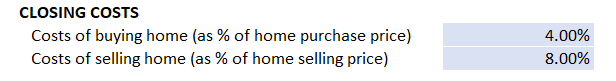

When you buy and sell a home, there are various fees that you must pay. Closing costs for the purchase of a home typically range between 3 to 6% and closing costs for the sale of a home typically range from 6 to 10%.

In our Fort Lauderdale example, let’s assume a middle point. We can set purchasing costs to 4% and selling costs to 8% of the home value.

MAINTENANCE AND FEES

As we discussed in the upfront section, homeowners take on responsibility for costs that renters do not need to pay. These include maintenance, homeowner’s insurance, and annual HOA fees.

While maintenance costs will likely be highest in our first year and in years with unexpected issues (e.g., roof leaks, replacement of AC units), let’s assume that we will invest 1% of the home’s purchase price on maintenance and repairs.

For home insurance, we can assume the average for now: 0.46% of the home value. The HOA fee will vary by neighborhood or apartment building. In this case, let’s assume we have $1,200 in HOA fees for a community club house and shared mowing services.

RENT COSTS

Lastly, we must make key assumptions about rental costs. This is because rental rates and obligations in your city can also impact whether owning or renting is more practical.

In Fort Lauderdale, paying a security deposit and broker’s fee, each equivalent to one month’s rent, is common. We can add this to the calculator. We can also add 0.54% for renter’s insurance, based on the average cost in the state of Florida.

how to run the calculator and interpret the results

Now that we have finished inputting data into our calculator, we are ready to run the calculator. The calculator will take our inputs and tell us at what monthly rent it makes more financial sense to rent than buy. It will take into account differences in:

Initial costs: The expenses we incur when we first purchase (down payment and closing costs) or rent (security deposit and broker’s fee) a home

Recurring costs: The expenses we will pay regularly to own (mortgage payments, HOA fees, maintenance and renovations, property taxes, and homeowner’s insurance, with deductions for mortgage interest payments and property tax payments) or rent (monthly rent and renter’s insurance) the home

Opportunity costs: Foregone returns we would have earned had we invested our initial and recurring costs

Net proceeds: The money received from the sale of the home (gains from the sale, accounting for closing costs and capital gains taxes) or termination of a rental (return of the security deposit)

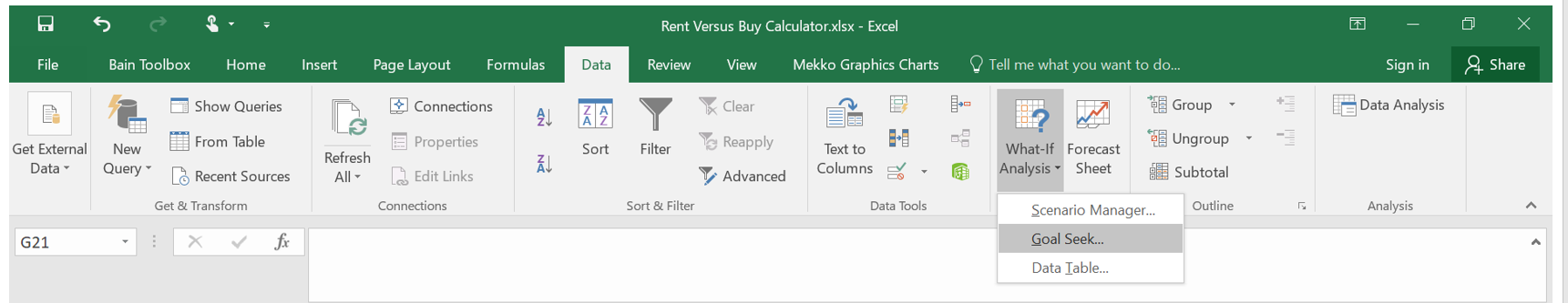

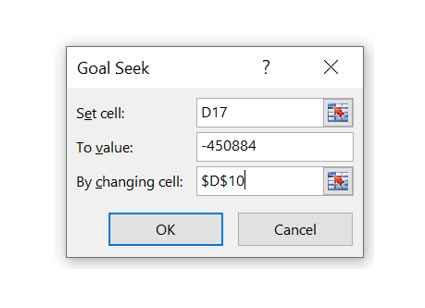

For the calculator to run, we must use the Goal Seek functionality on Excel. On the top menu, we can go to “Data,” click on “What-If Analysis” and select “Goal Seek.”

Goal Seek allows us to find the result (in this case the monthly rent) that will be cost equivalent to buying a home. When we click on Goal Seek, a menu will open. We must ask Goal Seek to set the total cost of rent (cell D17) equal to the value under buy (-450,884) by changing the monthly rent cost (cell D10).

Once we hit “OK,” the calculator will run the necessary calculations and output the following summary. The summary tells us that the cost of buying a home is equivalent to paying $2,373 of monthly rent. This means that if we can find a home to rent that is less than $2,373 per month, then renting will be financially cheaper than owning a home.

other considerations

We can use the information from the calculator as an input into our decision of whether to rent or buy a home in Fort Lauderdale. However, as mentioned earlier, cost is only one factor that we should take into account in this complex decision. These factors include:

FINANCIAL SITUATION

Evaluate your financial stability and readiness for homeownership. Do you have a steady income, a down payment saved, an emergency fund for unexpected expenses, and room in your budget in case property insurance or tax rates go up? If you decide to buy an older home and you find out that the roof needs to be replaced 2 years down the road, or that there is a plumbing issue, will you be able to cover such an expense, or will you have to take out a loan? People often stretch out to the maximum they are allowed to borrow (40-46% of your gross monthly income) to get the home they love. This is often a mistake because having that much of your income go towards your mortgage payment doesn’t leave you any room for the rest of your necessities and to be able to save.

desired lifestyle

Lifestyle considerations can also impact your decision to own or rent a home. Owning a home can provide stability and a sense of ownership, but it also comes with added responsibilities, such as maintenance and repairs. Renting may provide more flexibility and freedom to move around, but it also comes with less control over the property.

financial goals

Finally, your financial goals should also be considered when making the decision to own or rent a home. Owning a home can be a good long-term investment and can provide a source of equity for your future. Renting, on the other hand, can provide more flexibility and the ability to save for other financial goals. You should consider your goals holistically, including your retirement plans, savings goals, and debt obligations.

After owning a home for 7 years, I can personally tell you that it is very easy to spend a lot of money on maintenance, particularly if you are not handy. Between maintaining the lawn and appliances that break over time, the costs add up. And these costs don’t even account for aesthetic improvements that you might be tempted to make to your home. Very quickly home ownership can become more expensive than renting. Despite this, I am extremely grateful that my wife and I made the decision to purchase our home. We have been slowly building equity in a home that has almost doubled in value since we purchased it. As we think about expanding our family and potentially buying a second home, we are making plans to put our first home up for rent so that we can have a source of passive income well into the future.

While the decision of whether to rent or buy is challenging, you should take into account the cost and your financial health, lifestyle, and goals.