Retirement planning: how to get the most out of your retirement contributions

Retirement planning becomes increasingly important as pensions have almost disappeared from the market place and the stability of social security has come into question. As a result, employees in the United States are turning to their employer-sponsored 401(k) plans or IRAs to secure their financial future. However, even this seemingly straightforward step entails making several important decisions. Questions like, "How much should I contribute?" and "Which type of retirement account is best for my circumstances?" often arise.

In this article, we will explore the various types of contributions and shed light on the significance of correctly understanding and maximizing your 401(k) company match. You will discover how getting this aspect right can have a substantial impact on your retirement savings.

The Power of Compounding

One of the reasons why saving for retirement is so important is the power of compounding interest. Compounding interest allows your contributions, the company matches, and the returns generated by both of those investments to grow year by year. The earlier you start saving for retirement the more years that money is able to grow.

For example: Let's consider two individuals, Alex who starts contributing to his 401k at age 35 and Emma, who contributes the same amount a year but starts at 25. To keep the contributed amount the same for both parties, let’s assume that Emma stops to contribute at age 55 but the retirement account is allowed to stay vested another 10 years until they both reach 65. Assuming a 7% annual return on their investments:

Alex contributes $5,000 a year for 30 years for a total of $150k

Emma also contributes $5,000 a year for 30 years for the same total contribution of $150k

At 65 years old, a 10 year difference of compounding interest would result in the following:

Alex's 401k account would have approximately : $510k

Emma's 401k account would have approximately: $1M

As you can see, Emma’s retirement savings are significantly higher due to the power of compounding interest. It is estimated that an extra 8-10 years of having your money vested in the market can essentially double your savings and this is the reason why starting early is one of the best decisions you can make.

selecting an account: 401(k) VS. IRA, traditional vs. roth

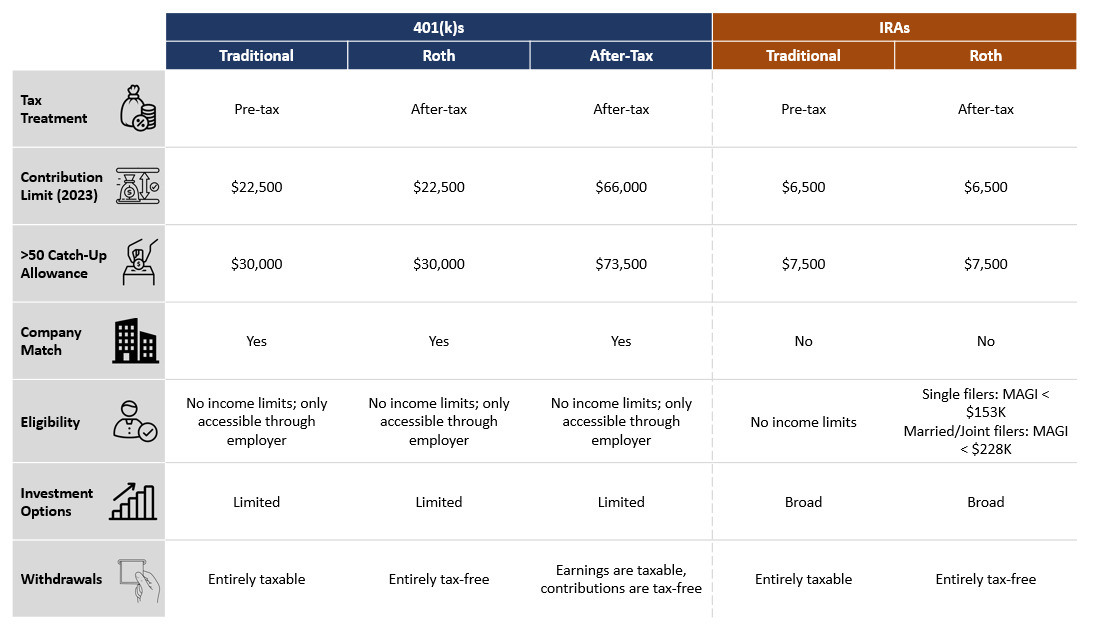

The first decision you'll confront is choosing in which account to enroll. The choice among the different accounts depends on your current financial situation, expected future tax bracket, and individual retirement goals. And in many cases, you may wish to use a combination of these accounts to create a tax-efficient retirement strategy. So here is what you need to know about each:

401(k)s vs. iras

The first helpful distinction is understanding the difference between 401(k)s and IRAs. The difference is simple: 401(k)s are retirement accounts offered through employers, whereas IRAs are typically opened by individuals through a broker or a bank.

This means that while your options for a 401(k) plan will be limited by your employer, you are eligible to open additional IRA accounts on your own.

Traditional vs. ROTH vs after-tax 401(k)s

Most employers offer a traditional 401(k) plan to employees. Some may also offer a Roth 401(k) or After-Tax 401(k).

Traditional 401(k)s are the most common and widely recognized form of retirement account. They are made on a pre-tax basis, which means the money is deducted from your salary before taxes are applied. This reduces your taxable income for the year and allows your contributions to grow tax-deferred until retirement. This is a great benefit if you think that you will not have any other sources of retirement income. In these instances, it may result in lower taxes in retirement, when your income is lower.

Tax treatment: Contributions are made with pre-tax dollars (effectively lowering your taxable income), withdrawals in retirement are taxable

Contribution limits: In 2023, the annual contribution limit is $22,500 ($30,000 if you are 50 or older)

Eligibility: There are no income limits for participation; employer must offer the plan to participate

Withdrawals: Withdrawals are taxed as ordinary income in retirement, and early withdrawals before age 59 1/2 may incur penalties. RMDs (required minimum distributions) by 73 years old

Roth 401(k)s are similar to traditional 401(k)s with the exception of the tax treatment. Contributions to Roth 401(k) accounts are made with after-tax dollars, with the advantage that in retirement, the withdrawals are tax-free. This type of account can be beneficial for families that are planning to have a source of income well into retirement age. This may apply to you if you plan to have real estate investments, a business, an inheritance, or other source of incomes during retirement.

Tax treatment: Contributions are made with after-tax dollars, withdrawals in retirement are tax-free

Contribution limits: The same limits as a traditional 401(k) apply. In 2023, the annual contribution limit is $22,500 ($30,000 if you are 50 or older)

Eligibility: There are no income limits for participation; employer must offer the plan to participate

Withdrawals: Withdrawals of both earnings and contributions are tax-free as long as you are at least 59 1/2 years old and have had the account for at least 5 years. RMDs (required minimum distributions) by 73 years old

The after-tax 401(k) option is often confused with Roth 401(k)s, but they have distinct differences. After-tax contributions are made with income that has already been taxed but the withdrawal of earnings are subject to tax. Another key distinction is that after-tax contributions are not subject to the $22,500 limit (for 2023), but, instead, they are subject to the overall limit on plan contributions, which for 2023 is $66,000.

After-tax 401(k) plans allow individuals to invest more than Roth 401(k) plans, which makes it a good option for those who want to max out their contributions to a traditional or Roth 401(k) and want to stash more money away in a retirement plan.

Tax treatment: Contributions are made with after-tax dollars, only the earnings portion of withdrawals in retirement are taxable

Contribution limits: You can contribute additional funds beyond the regular 401(k) limit; in 2023, the annual contribution limit is $66,000 ($73,500 if are 50 or older) and includes any employer matching funds

Eligibility: There are no income limits for participation

Withdrawals: Contributions can be withdrawn tax-free, but earnings are subject to regular income tax upon withdrawal. RMDs (required minimum distributions) by 73 years old

Traditional vs. ROTH iras

Traditional IRAs are similar to traditional 401(k)s in that contributions are made on a pre-tax basis. However, traditional IRAs are associated with lower contribution limits.

Tax treatment: Contributions are made with pre-tax dollars (effectively lowering your taxable income), withdrawals in retirement are taxable

Contribution limits: In 2023, the annual contribution limit for IRAs is $6,500 ($7,500 if you are 50 or older)

Eligibility: There are no income limits for participation

Withdrawals: Withdrawals are taxed as ordinary income in retirement, and early withdrawals before age 59 1/2 may incur penalties. RMDs (required minimum distributions) by 73 years old

Roth IRAs are a popular choice for retirement savings for individuals who expect to be in a higher tax bracket during retirement or that want to leave a tax-free inheritance to heirs. Roth IRA contributions are made on an after-tax basis. Both the contributions and earnings are tax-free in retirement.

Tax treatment: Contributions are made with after-tax dollars, withdrawals in retirement are tax-free, including investment gains

Contribution limits: In 2023, the annual contribution limit for IRAs is $6,500 ($7,500 if you are 50 or older)

Eligibility: Single tax filers must have a modified adjusted gross income (MAGI) of less than $153,000. If married and filing jointly, your MAGI must be under $228,000

Withdrawals: Contributions can be withdrawn at any time without penalties, and earnings can be withdrawn tax-free after age 59 1/2 and having the account open for at least five years. No RMDs (required minimum distributions)

401(k) Company Match: key input into retirement strategy

Most likely, your employer offers a 401(k) company match benefit. In order to decide which retirement saving strategy is best for you, it is important to understand the extent of your employer’s match.

What is a 401(k) Company Match?

A 401(k) company match is a benefit provided by many employers to encourage employees to save for their retirement. It is essentially free money that your employer contributes to your retirement account based on the amount you contribute. The most common form of a 401(k) match is a dollar-for-dollar match up to a certain percentage of your salary, often expressed as a percentage (e.g., 3%, 4%, or 6%).

How Does It Work?

Let's say your employer offers a 4% match. If you earn $50,000 per year and contribute 4% of your salary to your 401(k), which is $2,000, your employer will also contribute $2,000. This means that you have effectively doubled your retirement savings contribution without any additional effort on your part. You have effectively made a 100% return on that investment before the money is even invested and allowed to grow. If you compound that invest over your life until you reach retirement age, that investment will pay you back many time overs what you invested. We will dive more into this in the next section.

so what is the optimal retirement saving strategy?

To ensure you set the best strategy, follow this three-step process:

Maximize your employer’s match: Familiarize yourself with the specifics of your company's 401(k) policy. If your employer offers a 401(k) company match, calculate the share of your salary you need to contribute to receive the full match. In other words, if your employer matches your contributions up to 3% of your salary, contribute at least 3% to maximize this benefit. Since any matching contributions are essentially “free money,” you want to ensure that you don’t leave any money on the table.

Prioritize the rest of your accounts: Assess your current and future tax situation to determine which accounts you max out first. If you believe you will have sources of income or will be in a higher tax bracket in retirement than you are today, then try to max out your Roth 401(k) or IRA accounts first. If the opposite will be true, try to max out your Traditional 401(k) or IRA accounts. While doing so, be aware of annual contribution limits.

If you are still unsure of which account to max out, a good rule-of-thumb is to max out your IRA first. IRAs offer more types of investment options, such as low-cost mutual funds and ETFs. Additionally, IRAs are associated with lower administrative fees.

After maxing out your benefits from one type of account (401(k) or IRA), consider maxing out the other.

Review and adjust: Regularly review your 401(k) contributions and adjust them as your financial situation changes. Take into account any raises, bonuses, or changes in financial situation.

In an era of increasing life expectancies, it's crucial to ensure that you have enough savings to maintain your desired lifestyle throughout retirement. Many families underestimate the amount they will need for retirement or procrastinate on making the necessary plans because the topic can be daunting. Overall, the two most important takeaways are 1) start to save as early as possible and 2) maximize the company match offered by your employer. By taking these two steps, you will benefit from the power of compounding and earn “free money.” Your future self will thank you.