How much should I have saved in my 401k

Many individuals like to have a benchmark for how much they should have put aside in their 401(k) by various ages to determine whether they are on track for retirement. The difficulty with providing a direct benchmark is that the answer varies greatly on your personal situation, including income and lifestyle. For example, while one individual may be able to live on a $40k per year retirement withdrawal per year, others may require $100k per year in retirement. One individual may own multiple rental properties that provide them with a secondary source of income, while others may be entirely dependent on their 401(k).

In this guide, I walk you through how to estimate how much you will need to set aside in your 401(k) at various age ranges. I also provide general benchmarks, with the hope that both of these data points will serve as guidelines to help you assess your progress toward a secure retirement.

calculating how much you need to contribute

STEP 1: ESTIMATE YOUR RETIREMENT NEEDS

The first step to determining whether you are on track in your retirement savings is to estimate what kind of lifestyle you want during retirement. You should start by asking yourself the following questions and writing them down on a piece of paper:

At what age would you like to retire?

How much income do you estimate you will need per year of retirement? Ideally, you want to consider your expenses in retirement (e.g., whether you will have paid off your mortgage by then, the type of lifestyle you want to have). If you have trouble answering this question, I recommend estimating that you will require 70 - 80% of your pre-retirement income. While many families assume they will need much less, oftentimes travel and uncovered health care expenses rise during retirement.

Do you expect to have any additional sources of income during retirement, or will you be solely relying on Social Security benefits and your 401(k)? If your 401(k) will be your only source of income during retirement, continue reading. If you expect to have other sources of income, then you should subtract their amount from the total estimated income you will need in Question 2.

For example: Imagine that Nancy is 30 years old. She makes $150K per year and knows that she would like to retire at age 67. Nancy does not expect to have any additional sources of income beyond her retirement savings. She recently took our a mortgage and expects that the payments will be complete by the time she retires.

Since Nancy is not sure how much she will need for retirement, she decides to estimate that she will need 80% of her current income. This means that Nancy will need to save enough money so that she can withdraw $120K per year during her retirement.

STEP 2: divide your estimated desired income BY 4%

Now that you know exactly how much money you will need each year, you can work backwards to arrive at how much you need to contribute to your retirement account. All you need to do is divide the amount you calculated above by 4%. This calculation will tell you exactly the amount of money you need to save by retirement to be able to safely live off of your retirement indefinitely.

For example: Going back to the earlier example, Nancy calculated that she will need $120K per year during retirement. She divides $120K number by 4% to arrive at $3M. This means that Nancy must save $3M across her contributions, company match, and investment returns to be able to withdraw $120K each year during retirement.

STEP 3: CALCULATE NECESSARY CONTRIBUTIONS

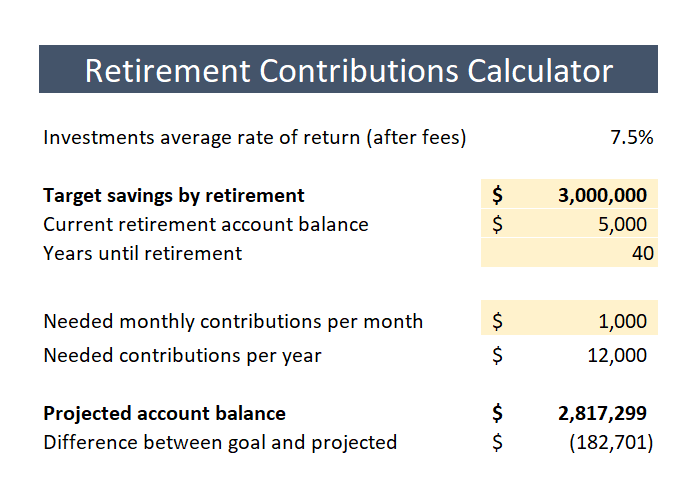

In order to determine your necessary contributions to a retirement account, I have created a retirement contributions calculator. First, we must make a few assumptions, including the number of years you will contribute to the account and the average investment return during this timeframe. For ease, we can use some placeholder assumptions based on historical averages. However, feel free to change these assumptions in your calculations based on your individual circumstances.

The averages are as follows:

Years of contributions: 40

Average return: 7% (the average return ranges from 5 to 8%, but higher returns averages are possible)

After plugging in your desired (or “target”) savings by retirement, your current retirement balance, and years until retirement, you can calculate exactly how much you should be contributing on a monthly basis. You can either use the Goal Seek function in Excel or try and test different monthly contribution amounts until the projected account balance equals or is greater than you target savings.

If your desired retirement age in 65 years old, you would need to contribute $9,650 a year for 40 years with a 7% average return. If instead you were able to average 9% return over the same 40 years, you would only need to contribute around $5,500 a year. The investment return and the number of years that you have left until retirement play a huge role in how much you need to contribute to reach your goals. Therefore, it is easier for you to use the calculator below to take those into your personal details into consideration.

For example: Nancy has determined that she needs to save $3M across her contributions, company match, and investment returns to be able to withdraw $120K per year during retirement. Using the calculator, she plug in her target $3M in savings, her current retirement account balance ($5K), and the number of years she has left until she retires (40 years). Now, she tries different monthly contribution amounts to see how much she must contribute (inclusive of her company’s match) to get to $3M in savings. She first tests whether $1K per month would be enough but she realizes that it would fall under her target ($2.8M instead of $3M). She increases her monthly contribution to $1.1K per month and realizes that by saving $100 more per month, she will be able to reach her target.

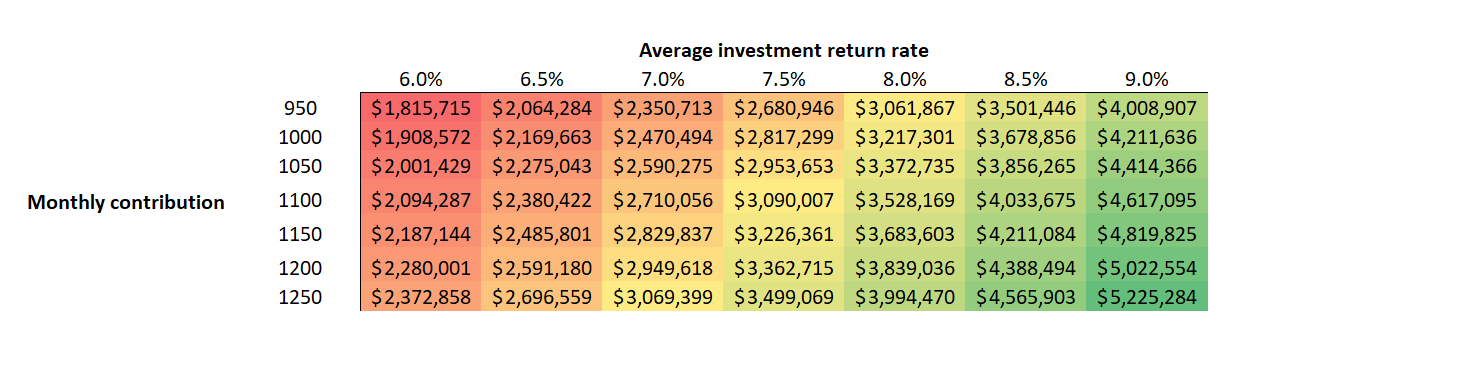

It is important to note that the results of the calculator are highly dependent on the average return rate that you earn across your lifetime. In Nancy’s example, you can see in the following table how a slight increase or decrease in the average return has a significant impact on how much Nancy has to contribute. If her returns earn an average rate of 7.0% instead of 7.5%, she has to contribute closer to $1.25K per month to reach her goal.

What does this mean for you? It is wise to be aware of your saving’s sensitivity to average return rates, and consider your risk tolerance which usually determines the kind of returns you will be able to get. You should select how the money is invested wisely and assume a conservative rate when making the decision of how much to contribute.

general BENCHMARKS

For those who feel lost in determining how much income they will need in retirement, this section will give you rough estimates of how much you should be contributing to your 401(k) without considering your financial needs in retirement. This generic approach should serve as a guide post; you should revisit the calculations in the section above as you gain a better idea of your needs.

In Your 20s: Establish a Foundation

In your 20s, the focus is on establishing a solid foundation for your retirement savings. Financial experts often recommend contributing at least 15% of your annual income to your 401(k) during this period, including the company match.

In my case, my company matches 100% of the first 3% and 50% of the next 3%, so the maximum contribution match my employer offers is 4.5% as long as I contribute 6% of my income. In total, this gets me to a contribution of 10.5% of my income. This is exactly how much I contributed during my first few years of being a working adult while I looked to save for a down payment on a home. Over time, I increased my contributions to 15% of my income and in some years maxed out my 401(k) and IRAs.

If you are not able to contribute 15% in your early years, you should at least strive to get the full company match, or else you are leaving free money on the table. By starting early, you benefit from the power of compounding, allowing your investments to grow over time. This is the reason why it is super important to contribute as soon as you start working and never give in to the temptation of not contributing for any reason.

Benchmark: Aim to have one year's salary saved in your 401(k) by the time you reach 30.

In Your 30s: Accelerating Savings

As you enter your 30s, consider increasing your contributions to take advantage of salary increases and additional financial responsibilities. Aim to contribute 15-20% of your income to your 401(k). If you haven't reached the one-year salary milestone in your 401(k), strive to get there during your early 30s because by the time you reach 35, you want to have 1.5 times your salary.

Benchmark: Aim to have 2.5 to 3 times your annual salary saved by age 40.

In Your 40s: Fine-Tuning Your Strategy

In your 40s, it is time to fine-tune your retirement strategy. Continue contributing a minimum of 15-20% of your income to your 401(k) or even maxing the allowed amount by the IRS if you have fallen behind and you are trying to catch up. Consider reassessing your risk tolerance and adjusting your investment portfolio accordingly.

Benchmark: Aim to have 6 times your annual salary saved by age 50.

In Your 50s: utilizing Catch-Up Contributions

As you enter your 50s, take full advantage of catch-up contributions to turbocharge your savings. At this stage, it's essential to reassess your retirement goals, estimate your future expenses, and adjust your savings accordingly. Focus on reducing debt to free up more funds for retirement contributions.

Benchmark: Aim to have 8-11 times your annual salary saved by age 60.

In Your 60s: Approaching Retirement

In your 60s, retirement is on the horizon. Continue contributing to your 401(k) and make the most of catch-up contributions. Assess your retirement goals and develop a withdrawal strategy. Consider consulting with a financial advisor to ensure that your savings align with your retirement lifestyle.

Benchmark: Aim to have 10-18 times your annual salary saved by the time you retire.

Factors Influencing Retirement Savings

Hopefully by now you have a good sense for how much you should be contributing to your retirement accounts. As you fine tune your calculations, I wanted to take the time to cover the five factors that have the biggest impact on how much you save for retirement. These include:

Income and Lifestyle Goals

Your income level and desired lifestyle in retirement are significant factors in determining how much you should have saved. Higher-income earners may need more substantial savings to maintain their lifestyle, while those with more modest incomes might find their retirement needs are met with a smaller nest egg.

Investment Performance

The performance of your 401(k) investments can impact the growth of your savings. While past performance does not guarantee future results, a diversified and well-managed investment portfolio is crucial. Regularly review and adjust your investment strategy based on your risk tolerance and financial goals.

Employer Contributions and Matches

Employer contributions effectively reduce the amount that you must contribute to reach your desired goal. The most important thing is that you take full advantage of employer contributions and matches. You can do this by contributing at least enough to receive the maximum company match – it is essentially free money that can significantly enhance your retirement fund.

Market Conditions and Economic Factors

External factors, such as market conditions and economic trends, can influence the growth of your investments. While you can't control the market, you can control your contribution rate and investment strategy. Stay informed, but avoid making impulsive decisions based on short-term market fluctuations.

Healthcare Costs

Consider potential healthcare costs when planning for retirement. Healthcare expenses can be significant, especially as you age. Ensure that your savings are sufficient to cover potential medical costs and provide for a comfortable retirement.

Strategies for Boosting Your 401(k) Savings

If you are hoping to increase your contributions, consider the following strategies:

make Consistent Contributions

Consistency is key to building a substantial 401(k) balance. Set up automatic contributions from your paycheck to ensure that you consistently save for retirement. This approach eliminates the temptation to spend the money before it reaches your retirement account.

Take Advantage of Catch-Up Contributions

Once you turn 50, you become eligible for catch-up contributions, allowing you to contribute more to your 401(k) than the standard annual limit. Take full advantage of this opportunity to accelerate your savings in the years leading up to retirement.

Reevaluate Your Budget Regularly

Regularly reassess your budget and look for opportunities to increase your retirement contributions. This may involve reducing unnecessary expenses, finding additional sources of income, or redirecting windfalls, such as tax refunds or bonuses, toward your retirement savings.

Maximize Employer Matches

If your employer offers a matching contribution, contribute enough to maximize this benefit. Failing to do so means leaving potential money on the table. Employer matches are a powerful tool for accelerating your retirement savings.

Diversify Your Investments

Diversification is a crucial strategy for managing risk and optimizing returns. Spread your investments across different asset classes to ensure that your portfolio is well-positioned to weather market fluctuations.

Regularly Review and Adjust Your Strategy

Life circumstances, financial goals, and market conditions change over time. Regularly review and adjust your retirement savings strategy to ensure that it aligns with your current situation and future objectives. Consult with a financial advisor if needed.

The journey to building a robust 401(k) and securing a comfortable retirement is a marathon, not a sprint. The benchmarks provided for different age ranges offer general guidance, but individual circumstances vary. Regularly reassess your financial goals, adjust your savings strategy as needed, and take advantage of opportunities to maximize your retirement contributions. With discipline, smart financial choices, and a commitment to your long-term financial well-being, you can navigate your 401(k) journey with confidence and build the retirement you envision.