how to set long-term and short-term financial goals

When I started my first job out of college, I was living at home and knew that I wanted my own space. I had two choices: I could rent an apartment close to the office or I could save up for a down payment to buy a home.

Growing up, my parents had taught me that I should always look to purchase a home over renting since mortgage payments build equity in the home. I knew that if I started renting an apartment, it would be harder to save money to buy a place later on. If I could save money for a down payment, I could make a smart financial decision and reap the benefits later in life. I decided this strategy was worth pursuing and the more aggressive I tried to save, the quicker I could buy a home. Once I knew what my goal was, it was easy to shift my daily expenses because I was focused on my goal.

While your goals will be unique to your individual circumstance and needs, deciding what they are and making the commitment to reach them will help you stay motivated and accomplish what you want. Below are guidelines to help you set your own personal financial goals.

Step 1: Determine Your Current Financial Situation

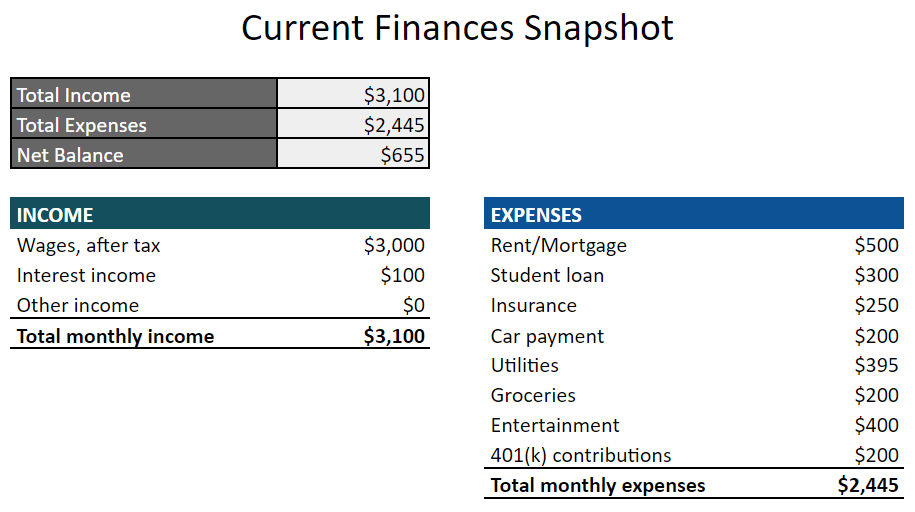

To set realistic goals, you first need to know where you stand financially, mapping out your monthly income and expenses, as well as assets (i.e., things you own, such as cash, investments, or property), and liabilities (i.e., debts you owe, such as credit card balances, loans, or mortgages).

I find it helpful to map these out in an excel, although you can also use a piece of paper. Below is a screenshot of a quick template you can create. Eventually you will need a more detailed template.

As you write down your expenses, it will be helpful to categorize them (e.g., groceries, car, entertainment) and to consider whether they are an “essential” or “nonessential” expense. As you do, you will identify spending patterns. For example, you might notice that you spend twice as much dining out than you do on groceries. Noticing these patterns will come in handy later, as you create a plan to reach your goals.

Step 2: Identify Your Goals

Once you have assessed your financial situation, you can begin to identify your goals. These goals can be short-term or long-term:

Think of short-term financial goals as those you want to achieve in the next 6 - 24 months. For example, paying off credit card debt, building an emergency fund, improving your credit score, or saving for a vacation.

Long-term financial goals are those you want to achieve in the next three years or longer. Examples include saving for retirement, buying a house, or paying for your children’s college education.

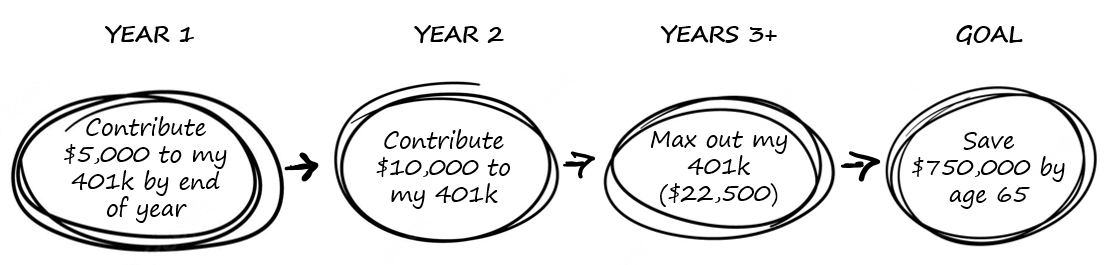

When identifying your goals, make sure they are SMART (specific, measurable, achievable, relevant, and time-bound). For example, instead of setting a goal to “save for retirement,” set a goal to “save $750,000 for retirement by age 65.” See below on how I turned a regular goal into a SMART goal:

Specific: What do I want to save for? - Retirement

Measurable: How much do I want to save? - $750,000

Achievable: Is this goal realistic? - Yes, since I have 30 years until retirement, I could reach this goal by maxing out my 401(k) each year and letting the money earn returns in the market

Relevant: Is this goal important to me? - Yes, I want to ensure that I have money set aside for when I will need it most

Time-bound: When will I meet the goal? - I want to meet the goal by age 65

Once you have the high-level goals, take a moment to break down the goal into smaller goals. This is what it may look like:

The shorter deadlines create a sense of urgency and give you a clear definition of what success looks like.

Once you have 3-5 goals written down, you should prioritize them, focusing on those that are most important to you. It is harder to accomplish multiple goals at the same time, but if you break them down by priority and you start scratching them off one by one, you will be more motivated to keep working at them. Seeing the results from your hard work will be just as satisfying as seeing your goals completed.

Keep in mind that while your priorities will change through the different faces of life, retirement should always be one of your top goals. It might be tempting to stop saving for retirement to save enough for a downpayment on a house that you really want. But halting contributions to your retirement account for 5 years is not the right approach unless this property is part of your retirement plan.

Step 3: Write Down Your Financial Goals

Nothing keeps you more engaged than seeing your goal every time you wake up, open your fridge, or turn on your laptop. Pick a place that you know you will see every day and your mind, whether consciously or unconsciously, will help you get there.

Step 4: Develop a Plan to Achieve Your Financial Goals

Once you have identified your goals, prioritized them, and broken them down into smaller goals, the next step is to develop a plan to achieve them. I like to do this by taking my one-year “small” goal and breaking it down into specific actions I need to take to achieve that goal.

For example, if your Year 1 target as part of your retirement goal is to contribute $5,000 to your 401(k) by the end of the year, your plan might include:

Creating a budget to track your income and expenses

Figuring out how much money is left in your budget to contribute to your 401(k)

If you notice you won’t be able to reach the $5,000 in contributions, looking for expenses to cut to free up more money (e.g., cutting down on dining out for the next few months, searching for a different service provider) or increasing your income by taking on a side job

Similarly to your goals, your plan should include deadlines for each action.

Step 5: Monitor Your Progress

The final step is to track your progress. Use the template you have set up or leverage an app like Mint.

As you track your progress, you may find yourself needing to adjust your plan. For example, if you find that you are not saving as much money as you had planned, you may see whether you can cut back expenses in a different category. Or, if you find that you are exceeding your savings goals, you may choose to move up your timeline. If you ever find yourself sacrificing more than you are comfortable with, make sure to reintroduce something that will bring you joy but will still allow you to make progress towards your goal.

With a clear understanding of your financial goals and a dedication to them, you can make progress towards financial flexibility.