budgeting basics: how to build a budget (and a Free budget template)

Budgeting is an essential financial skill that can help you take control of your money, help you pay off debt, and help you achieve your financial goals. Basic budgeting is always the first step to figuring out and understanding your financial health. In this article, we will discuss some practical tips and strategies for budgeting which will allow you to take control of your finances.

Start with a Budget Template

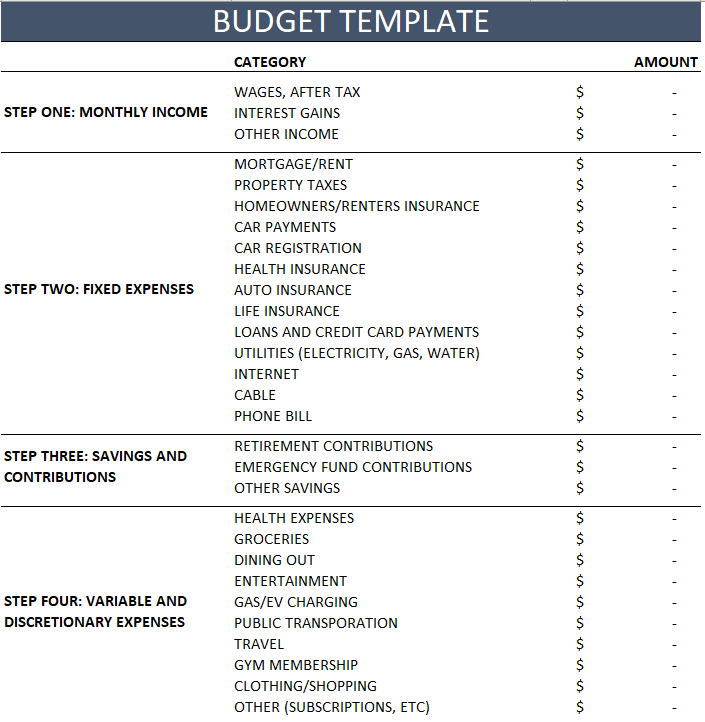

One of the easiest ways to get started with budgeting is to use a budget template. These templates are available online for free and can help you track your income and expenses, set financial goals, and plan for unexpected expenses. This is something you definitely don’t need to pay any money for. You can download a template. You can print it and write your numbers down on a piece of paper or you can use it in your computer which will add the totals for you.

When choosing a budget template, look for one that is easy to use and customize it to your personal situation. You can also create your own budget template using a spreadsheet program like Microsoft Excel or Google Sheets. If you are comfortable using apps and giving them your bank and credit card information, you can use apps like Mint that create a budget for you and allow you to see your progress every month.

Track Your Income and Expenses

The next step in budgeting is to track your income and expenses over a period of time. Start by listing all your sources of income, including your salary, any side hustles or freelance work, and any other income you receive. This will allow you to compare how much money you have coming in versus going out. It will also help you think about other ways you grow your income. Maybe you have been paid for doing a job that you were doing as a favor, like installing security cameras for a friend. Sometimes seeing that you can make money doing something you enjoy will help you identify side hustles that you can launch to grow your income.

Next, list all your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, entertainment, and any other expenses you have. Be sure to include both fixed expenses (like rent or car payments) and variable expenses (like groceries, transportation, eating out, or shopping). You should also include savings, such as contributions to your 401(k) or personal savings.

Categorize Your Expenses

Once you have listed all your expenses, categorize them into different groups, such as housing, transportation, food, and entertainment. This will help you see where your money is going and identify areas where you can cut back or make changes.

For example, if you notice that you are spending a lot of money on dining out or entertainment, you can consider cutting back on those expenses and reallocating that money to pay off debt or save for a financial goal.

Set Financial Goals

Budgeting is not just about tracking your expenses, it's also about setting financial goals and working towards them. Whether your goal is to pay off debt, save for a down payment on a house, or take a dream vacation, setting specific and achievable goals can help you stay motivated and on track.

When setting financial goals, be sure to make them SMART (specific, measurable, achievable, relevant, and time-bound). For example, instead of saying "I want to save more money," set a specific goal like "I want to save $50,000 for a down payment on a house within the next year."

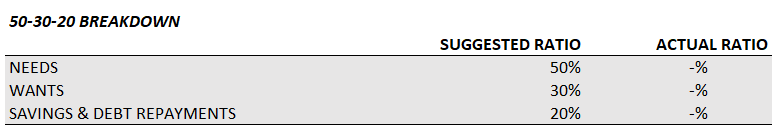

50-30-20 rule

As you set saving goals, there are helpful rule-of-thumbs to make sense of your expenses and whether they correlate to your income. A popular one is the 50-30-20 rule, which proposes that necessities (e.g., housing, transportation, health care, utilities, groceries, and child care) should account for 50%, wants 30% (e.g., clothing, dining out, entertainment, and gym), and savings and debt repayments 20% of your spending. The more you can increase the 20% bucket, the quicker you will get to fulfilling more of your lifetime goals. If you want to see how your expenses stack up to the 50-30-20 rule, you can use NerdWallet’s budget calculator or the worksheet I provided above.

Monitor Your Progress

Finally, it's important to monitor your progress and make adjustments as needed. Review your budget regularly, at least once a month, and see how you are doing compared to your financial goals.

If you are not meeting your goals, look for areas where you can cut back or make changes. This might mean finding ways to reduce your expenses, increasing your income through side hustles or freelance work, or finding ways to save on the expenses you already have.

Budgeting can be a powerful tool for achieving your financial goals, but it takes time and dedication to get it right. By starting with a budget template, tracking your income and expenses, categorizing your expenses, setting financial goals, and monitoring your progress, you can develop the skills and habits you need to take control of your money and achieve financial freedom.