HOW TO BUILD credit AND IMPROVE YOUR CREDIT SCORE

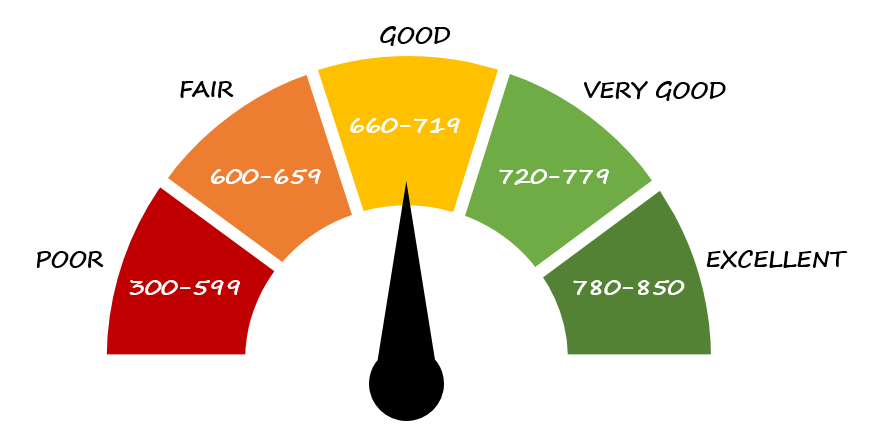

If you are just starting out in the world of credit, you may be wondering what creditors look for and whether you would get approved for a loan for a car, a new credit card, or to buy a house. A credit score is a numerical representation of your credit worthiness and it is used by lenders to determine your eligibility for loans, and other forms of credit. Building a good credit score is important if you want to obtain credit in the future, and it requires responsible financial management. In this article, we will discuss some tips and strategies for starting to create a good credit history and a great credit score.

Open a Credit Account

The first step in creating a credit score is to open a credit account. This can be a credit card, a car loan, or another type of credit account. However, if you are just starting out, it may be difficult or expensive to obtain credit due to a lack of credit history. If possible, you should wait to apply for any large loan amount since you will be forced to pay additional interest for your lack of credit history. Instead, start by applying for a secured credit card. These types of credit cards require a deposit because they are designed for people with little or no credit history. The deposit is made to cover some of the risk that the credit card company is taking by giving you a line of credit. In exchange, you get a chance to build your credit rather quickly as long as you stay current with your payments and use the strategies below.

Make On-Time Payments

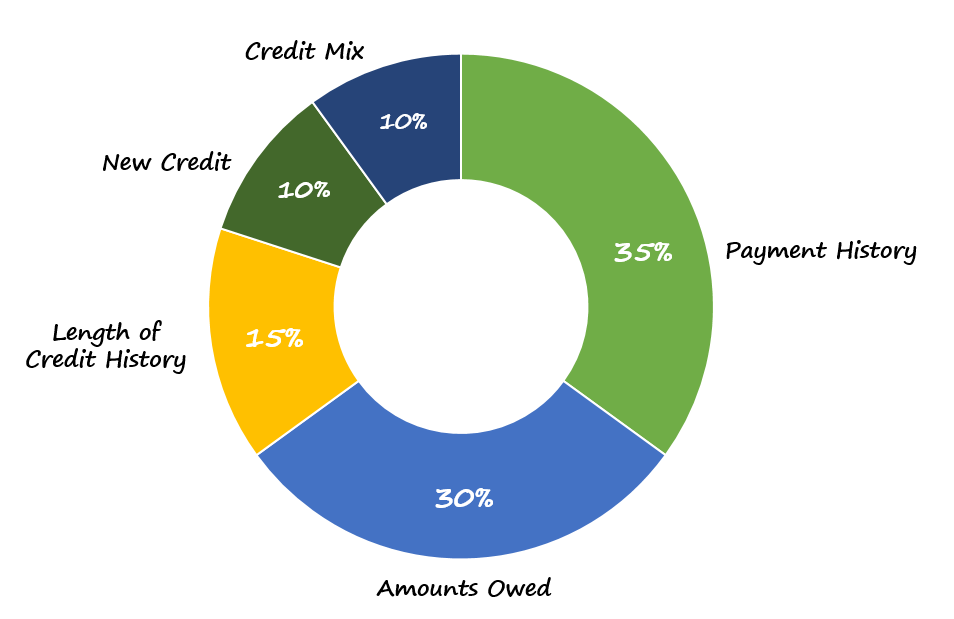

One of the most important factors in creating a good credit score is making on-time payments, which makes 35% of your credit score (see chart below on how important each factor is). Late payments can have a significant negative impact on your credit score, so it is important to make your payments on time every month. Most late payments don’t get reported unless you are more than 30-45 days late, so even though you should never be late, if you are, make sure your payment is sent as soon as possible. Also keep in mind that if you are late with your payment, you will be charged a late fee. To avoid this, consider setting up automatic payments or payment reminders to ensure that you never miss a payment. This can help you establish a positive payment history and improve your credit score over time.

Keep Your Balance Low

Keeping your balance low is another important factor in creating a good credit score. Your credit utilization accounts for 30% of your credit score, which is the amount of credit you use compared to your available credit. It is important to keep your credit utilization ratio below 25% to maintain a good credit score. This means keeping your balance low and not maxing out your credit card. Keeping your utilization ratio below 10% is actually even better and will prove to creditors that you have the financial discipline to not overextend yourself.

To put this into practice, imagine that your credit limit on your card is $50,000. You would want to keep your balance below $12,500 at all times and, in an ideal case, below $5,000 if you want to see significant improvements in your credit score.

I have personally experienced how hard it is to do this when you are just starting out and your secured credit limit is very low. Sometimes just a few expenses for the month can make your credit utilization ratio high. If this happens, there is a trick: you can make a partial payment to your credit card before the statement closes. This tactic will effectively lower how much you owe when the payment is due, as well as the utilization ratio. It will allow you to use your card and keep your ratio low as soon as you start building your credit, helping you build a great credit history quickly.

Monitor Your Credit Report

Monitoring your credit report is important to ensure that all information is accurate and up-to-date. Your credit report contains information about your credit history, including loans, credit cards, and payments.

You can obtain a free credit report from each of the three major credit reporting agencies - Equifax, Experian, and TransUnion - once per year. Review your report for errors such as incorrect payment histories, inaccurate personal information, fraudulent accounts, and not favorable credit history that is past the 7 year mark which can be removed. If you find any errors, dispute them with the credit reporting agency immediately or with the creditor that is reporting that history. Creditkarma.com is also a great resource to track your credit history/score which allows you to see an estimated TransUnion and Equifax score as well as all open and closed credit accounts under each of those reports. The reports on credit karma used to update weekly but now seem to be updating daily which is a great feature.

Use Credit Responsibly

Using credit responsibly is important in building a good credit score. This means making payments on time, keeping your balances low, and avoiding taking on too much debt.

Consider using your credit account only for purchases you can afford to pay off in full each month. This will help you establish a positive payment history and improve your credit score.

Build History Faster With More Accounts

When I was first starting to build my credit history I thought that the more credit cards you have the worse you would look to creditors, but that is actually not the case. If you are trying to build credit history really fast consider taking out 2 secured credit cards, or one secured credit card and a small car loan. Each creditor will report every month your timely payments and therefore create good history in your name faster than if you only had one account. The more creditors you have reporting good payment history, the quicker you will build up a good score.

Be Patient

Building a good credit score takes time and patience and cannot be done from one day to the next. Even with all the techniques mentioned above, the process still takes time. It may take several months or even a year or two to see a significant improvement in your score. However, if you follow these strategies consistently and you maintain responsible financial habits, you can achieve a higher credit score and enjoy the benefits that come with it.

In conclusion, creating and improving your credit history is easy, and even easier when you follow the points discussed above. Open a secure credit card, keep your credit utilization low, consider opening multiple accounts to build your history faster, review your credit history for any errors, and be patient. Overall, a credit history is a mathematical calculation that takes into account your payment history over time. Fortunately, the most recent history is weighed most heavily, which means that a few months of making payments on time will make a big impact. In future articles, I will dive into how to remove credit events that may be hurting your score from your credit history.